A few months ago I was on the Lite Show (Litecoin) podcast, we got to talking about Facebook’s forthcoming crypto currency, which hadn’t been named yet. I mused then that it would totally suck for the entire crypto-currency space to have come this far with Bitcoin, et al only to have Facebook swoop in and take all the marbles. (In marketing parlance this maneuver is called “grabbing the microphone”)

Then Facebook announced their digital currency, it’s Libra, and it was met with immediate resistance. But the pushback, didn’t come from where one might expect it, from within the crypto community. There was plenty of commentary about it to be sure, but nobody from within the crypto space was saying that Libra had to be stopped.

No, the immediate pushback came from various tendrils of myriad states and government entities, including:

- Maxine Waters, immediately calling for Facebook to cease all work on Libra

- French Finance Minister Bruno Le Maire warning against Libra becoming a sovereign currency

- and most recently the G7 (at least recent when I last worked on this post), the G7 forming a task force to address the issues Libra raises, and urging the “highest possible level of regulation” on it,

This instant pushback against Libra seems even more intense than any initial government condemnations against Bitcoin itself when it started to gain traction over the initial ramp up. Perhaps there are good reasons for this, such as:

- In the rear-view mirror, it’s possible that governments now view giving Bitcoin some room to run was a mistake, and it opened a Pandora’s box (from their perspective) which would be unable to be contained, and

- Facebook provides an identifiable target – governments can actually pinpoint them and (for now) regulate or threaten to regulate them. They can’t target Satoshi Nakamoto or an open source repository of computer source code.

I mused in my dayjob’s #AxisOfEasy newsletter #102 that we seem to be arriving in a scenario depicted in the Mr Robot TV series, where the crypto-currency Bitcoin and a private, corporate sponsored e-coin dual for supremacy in the aftermath of a hacker induced economic collapse (In the series, Libra’s role is depicted as the fictionalized “Evilcoin” with Bitcoin starring as itself. The economic collapse also turns out to be a Trojan horse operation launched by China).

The only thing missing from today’s reality, as I write this, is the economic collapse part, but with stock markets at all-time highs, and the Fed cutting rates again in this ostensibly great economy, clueful observers the world over sense that something is about to give. Tangentially the stealth bull in precious metals and resurgence of Bitcoin, even in the face of Libra, all point toward the idea that not all of these economic indicators can be right at the same time. That means at some point a disorderly readjustment may occur.

Welcome to a New World Order. We call it “Snow Crash”

Snow Crash was the Neal Stephenson near-future thriller set against a backdrop in which national governments found themselves set back on their heels, competing against privatized sovereignties across a wide spectrum ranging from a multi-national pizza conglomerate to the global Mafia.

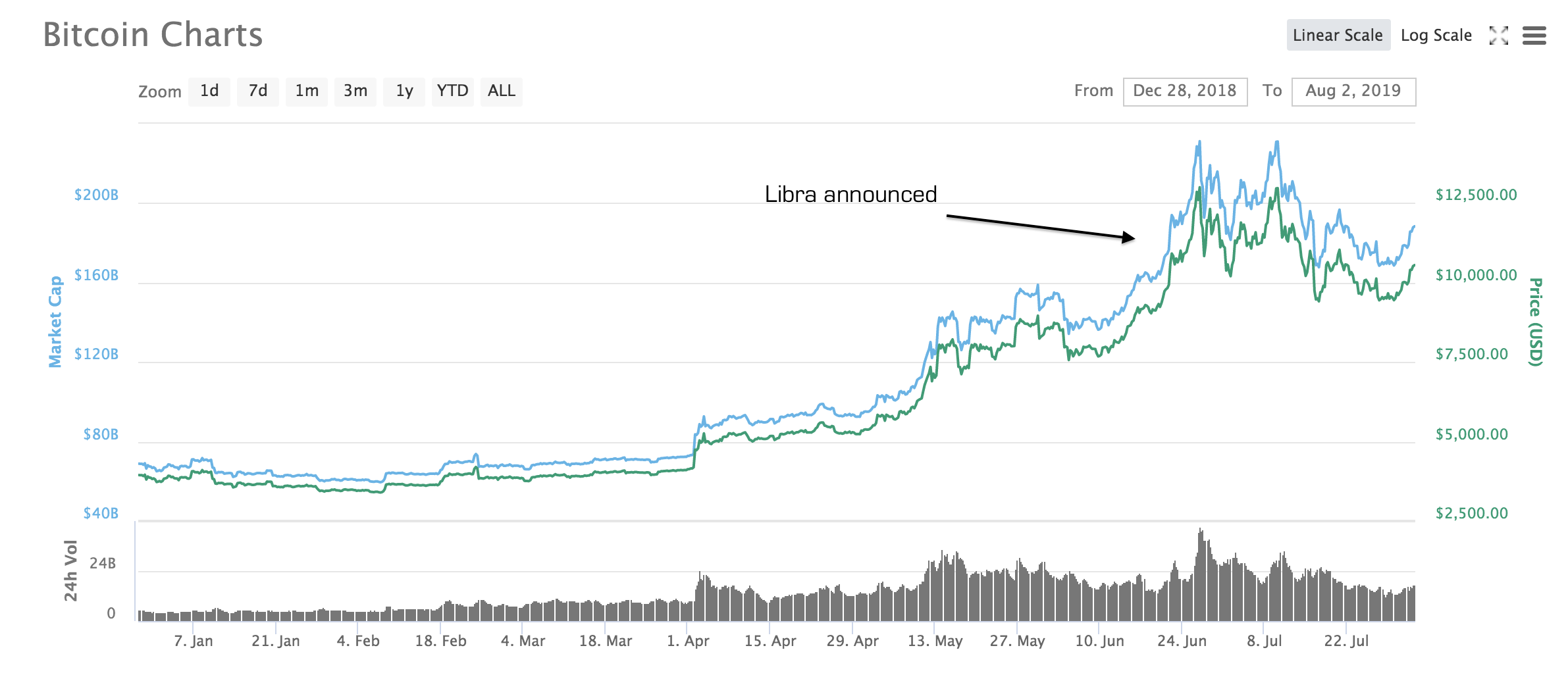

Why didn’t Bitcoin tank when Libra was announced? If one is to accept the superficial premise that Facebook will indeed swoop in and capture the digital currency space after Bitcoin softened the ground for them, the announcement should have had a similar effect to when Amazon announced it was buying Whole Foods, and grocers everywhere tanked hard. That didn’t happen, why not?

By contrast, Bitcoin has more or less held steady since the announcement, after giving back some ground after an initial spike higher post-Libra. In any case, there was no instantaneous death crash compared to when Amazon entered the grocery space.

The reason, I think, is because Facebook’s Libra isn’t challenging Bitcoin. Facebook, perhaps without even being aware of it themselves, is doing the same thing Bitcoin and crypto-currencies did when they emerged out of a financial crisis spawned by central bank manipulation and a currency regime so rigged as to destroy all market signalling capabilities: it challenged the prevailing economic order, and that order is the scaffolding of the nation state as we know it.

In other words, these crypto and digital currencies are ushering in a new era of competitive economic sovereignty, and with it, the decline of the hegemony of nation states.

One of the best books I’ve ever read that anticipated this disruptive shift in the nature of sovereignty was “The Sovereign Individual” by James Dale Davidson and the late Lord William Rees-Mogg (father of Brexiteer Jacob Rees-Mogg, who was once reportedly on the short list to replace https://bombthrower.com/wp-content/uploads/2019/03/shutterstock_1030471843-e1551983495127-1.jpg Carney to head the BoE).

According to that book: Nation states arose by capturing escalating returns on violence and force. The transition into the gunpowder era ushered in the rise of nationhood, and increasing returns on violence, right up until the collapse of the Berlin Wall in 1989. The fall of Eastern block, they argue, was not an ultimate victory of the West over Communism, as Francis Fukuyama asserted in The End of History. Instead they posited it more as the death of a fraternal twin, that of nation statehood.

As the returns on violence decreased as can be witnessed by every military disaster the US has undertaken since WWII, the other twin is now sclerotic and withering. So what does have increasing returns now? It isn’t violence anymore. It’s information. The shift from one to the other means that the nature of the monetary system will also shift.

The old order monetary system was built on Bretton Woods – a global reserve currency backed by US military imperialism. That system is going away and everybody knows it.

Money does not issue forth from power, recall my prior citations of Stephen Zarlenga: who controls the money system, controls society. Power emanates from money. Nation states and central banks assumed they would retain control of the money system indefinitely. They assumed that they could continue to manipulate the money supply to further their own interests (Cantillon Effect driven benefits) and there was nothing anybody would ever be able to do about it.

But Revolution has a way of lobbing disruptive, explosive technologies from the periphery where nobody is expecting an asteroid to originate. Did the major music labels expect to be reinvented by Apple? Did the Hollywood studios expect to be elbowed aside by Netflix and Amazon? And did the nation states and central bankers think disruption would encroach and fundamentally transform all aspects of society but stop at the demarcation point of sovereignty and money? Why yes, yes they did.

I have said repeatedly – the incumbent system has overreached itself, and out of that necessity came Bitcoin and crypto-currencies. This was essentially the market re-asserting itself in the face of endless manipulation.

Money has evolved, and is now reinventing itself for the next ascendant wave of increasing returns: information. Next, sovereignty will reconfigure itself to adjust to the new format of money. This is the opening that Bitcoin opened up, and Facebook is the among the first to make a move into it. And that’s why ensconced governments are so up in arms about it. They recognize direct, real competition to their own authority and relevance. The nation state isn’t going away any time soon, but the rise of the platforms isn’t going to be stopped, either.

In the future, your digital single-sign-on credentials that you use to access various online platforms (or the one platform from which you derive your entire sustenance and livelihood) will be as important to you, perhaps eventually more so, than your government issued passport.

Governments want to regulate how the Age of the Platforms will rise, which is similar to how the Papacy once deigned to guide and arbitrate royal succession. But over time this will reverse and it will be the Platforms that increasingly set the terms for nation states. Given the accelerated pace things move at today, this process will not play out over centuries, the way the transition from feudalism to nation states did, but over decades, even years in some places.

Today nobody raises an eyebrow that the Swiss National Bank is Apple’s largest shareholder by printing francs and buying shares. What happens tomorrow, when Facebook issues some Libra, sells them for USD to pay their taxes? Or to settle one of the myriad fines levied, like Papal encyclicals of yesteryear, against these upstarts? My guess is governments will scream foul, “only we can print value ex nihilo!”.

But the reality is that anybody can create their own monetary instruments provided they can find a market to ascribe value to it. Money has always changed with the times and arisen privately, the states then adapt, co-opting whatever emerges as money at the earliest possible opportunity. Looking back on today that may be what Libra is to Bitcoin. The equivalent of a Federal Reserve of Digital Currencies (the Libra Founders Association looks hauntingly like a modern, cyber analog to the member banks of the Fed).

The Real Battle of the Future

One might think that this means the battle of our times will be between the falling (failing) nation states and the rising Platform challengers, but that’s not the way I see it. In many cases nationhood and platform will effectively merge, witness China, where tech giants like Google and IBM’s Open Power Foundation is helping the Chinese government build out their Sesame Credit total surveillance platform.

In other situations, platforms may prevail, if Facebook or some other technology upstart is successful in their machinations they may become more relevant than the State in many jurisdictions. They may effectively become the de facto state in some areas.

In both these cases the defining characteristic will be centralization and consolidation of power and authority.

Against this, will be the ascendency of decentralized, autonomous sovereignties based on crypto-currency models and the original ethos of Bitcoin. Where Western Capitalism vs Communism was the defining question of the now ending age of industrial nation states, the fraternal twins of the future may be that of platforms vs protocols. The former centralized, consolidated, authoritarian as anticipated by Fukuyama and fleshed out today in The New Digital Age, Google’s manifesto penned by Jared Cohen and Eric Schmidt:

We collaborated first as writers of a memo to Secretary of State Hillary Clinton about lessons learned in Iraq, and thereafter as friends. We share a worldview about the potential of technology platforms, and their inherent power, and this informs all of the work we do, both within Google and outside it. We believe that modern technology platforms such as Google, Facebook, Amazon and Apple, are even more powerful than most people realize, and our future world will be profoundly altered by their adoption and successfulness in societies everywherer.

and the latter decentralized and anarcho-capitalist, anticipated by The Sovereign Individual and realized more now in George Gilder’s Life after Google

However it plays out, it will all be very cyberpunk.

My wife is a tax professional and I had a conversation with her a few months ago: “…has anyone at your tax conferences ever talked about crypto?”, “oh yes, the government is setting tax regulations around it”. “So how will they enforce disclosure?”. Silence.

cool…

and when Empire falls and the turbines spin down at the electric plant, the blockchains will be kept on, um, postits, or sumpin ? ? ? abacus ? knotted ropes ?

just wonderin’…