As an Amazon Associate OOTC earns referral fees from the book links we cite in our posts.

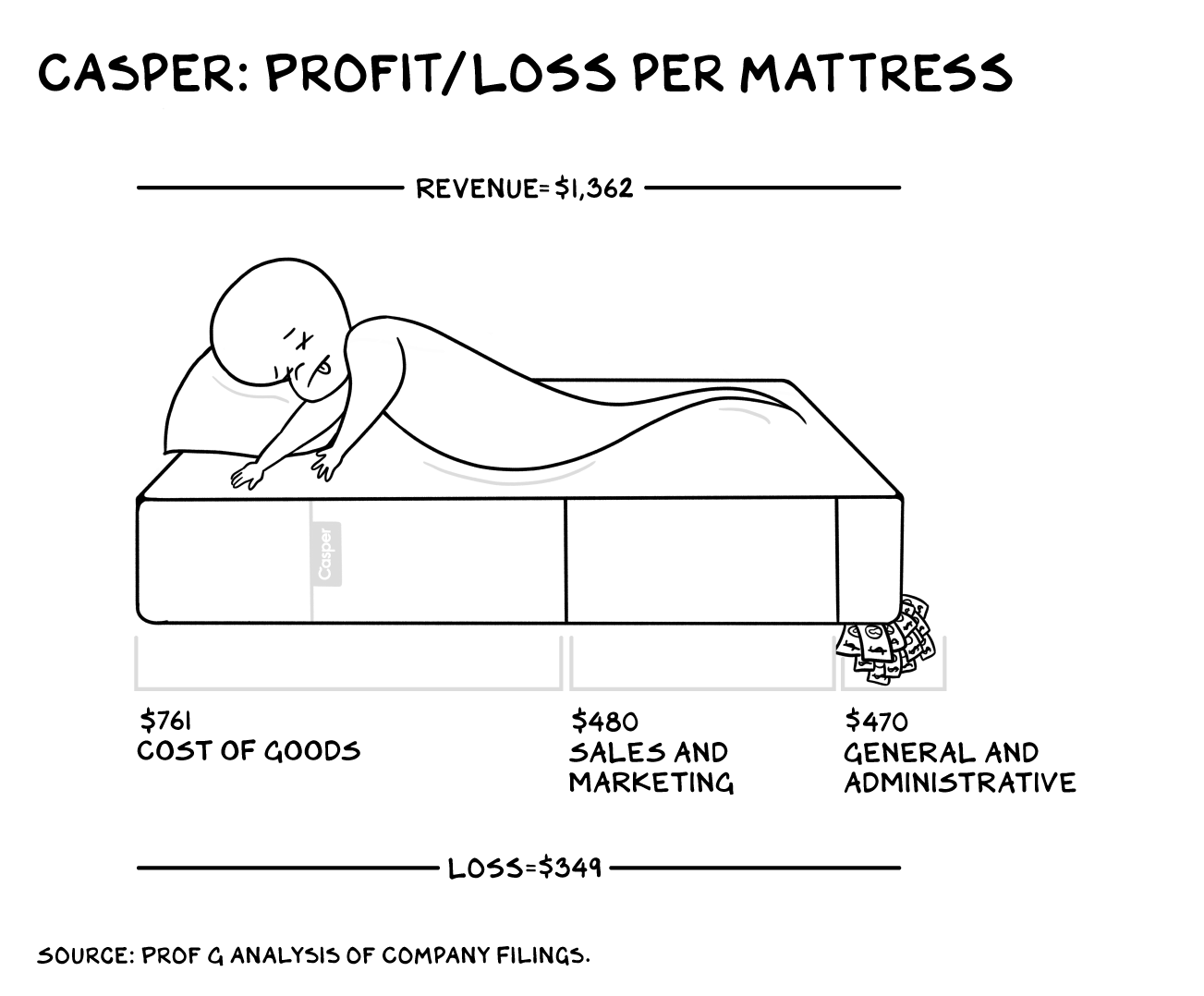

The theme for today’s post is from Scott Galloway’s (@profgalloway on Twitter) “Casper Should Not Go Public” post on Medium, which he wrote in response to the news that Casper, a mattress company I had never heard of, had filed to go public, having lost $73.4 million on $250.9 million revenues in 2017 and another $92.1 million loss on $357.9 million in 2018.

This post isn’t about Casper, the Galloway article is superb in analyzing exactly why anybody dumb enough to buy this IPO deserves to lose the 30% decline in stock price he posits for the first year (which I think is being charitable).

However, Casper will not go public, as it has no business being public. Casper’s numbers are a sign of a frothy economy: firms that should be sold in the private market doing a kabuki dance (“technology” mentioned over 100 times in prospectus), asking people to suspend their disbelief until the founders, VCs, and bankers sell their shares and get their fees. That’s not going to happen. Here too, yogababble won’t cut it: “We believe we are the first company that understands and serves the Sleep Economy in a holistic way.”

The economics work better if Casper sent you a mattress for free, stuffed with $300.

He also compared Casper to other players in their space, and adjacent space, mentioning that Away, is better differentiated in a less competitive space (there are 175 online mattress retailers!), and Warby Parker, who actually looks to be headed toward a successful IPO (because they actually have a real business).

It was a phrase near the end of the post which grabbed me, having circumscribed almost perfectly the frustration and angst rational economic actors have been feeling these past several years. Said rational economic actors include

- non-VC funded business owners

- people who save money

- people who pay down or pay off their debts

- fiduciaries responsible for investing and allocating capital

- and most anybody with a time horizon longer than the next quarterly earnings report

What he said was this:

Casper is being drowned and likely won’t survive. Away needs to be adopted by someone who will feed, clothe, and protect them. Warby looks to have the muscle and fat to survive an Amazon winter and emerge stronger.

It was that phrase “Amazon winter” that got me. Amazon poses such an existential threat to any sector it enters that even speculation that it may enter a space is enough to tank every public stock in it.

But it isn’t just Amazon that is scouring the economy looking for spaces to disrupt and so-called “value to unlock”, it’s every Amazon wannabe, trying to become the Amazon of their own space, or to lock up a “blue ocean” before somebody like Amazon can move in and eat it.

The end objective of all these players isn’t to have viable businesses, ones that do business the old fashioned way, at a profit.

Instead the end objective is to set in motion a cascading series of financial events at successively higher valuations. That’s the game now, and I’ve decided to call that game Unicorn Bingo. The macro effects of Unicorn Bingo are to usher in Unicorn Winter.

Unicorn Winter is the long, hard slog where credit induced asset bubbles on Wall Street suck up all the oxygen from Main Street.

It’s the Cantillon Effect, when geometrically increasing central bank balance sheets lift up the Unicorns’s valuations while pushing up the cost-of-living for everybody else.

The Unicorn Winter brings central bankers out of hibernation if the stock market pulls back 5%.

“Free markets”

Futures go up -> shorts get smoked

Futures crash -> CME steps in immediately -> Trump makes statement -> Powell capitulates -> Exchanges use circuit breakers -> Plunge protection team steps in -> Media starts doing 24/7 specials about buying the dip

— Quoth the Raven (@QTRResearch) December 5, 2018

The Unicorn Winter isn’t about making money, as in profits. It’s about monetizing what goes on in the mind of people who have no idea they’re being datamined.

Unicorns don’t create jobs. For the most part they create gigs. Temporizing everything from your home, your office, your server space, everything is delivered as-a-service, most likely at-a-loss and if there’s any humans involved in the chain at all it’s as part of somebody’s side hustle. Because that’s all there is now that everything else has been disrupted away in a sweeping tide of financialization.

In the Unicorn Winter even the also-rans get their hallowed exits.

- Adam Neumann became a billionaire for vaporizing WeWork

- Elizabeth Holmes is out seeking funding for her next deal

- And it all started when an entire class of banksters got bailed out for creating a financial crisis…

None of the bailed-out financiers here at #Davos2016 who live in Greenwich & collect Lamborghinis can understand why US voters are unhappy.

— Rudy Havenstein, Comité de salut public. 99.6°F. (@RudyHavenstein) January 21, 2016

But in the Unicorn Winter the people who didn’t want to play Unicorn Bingo don’t get exits. They get shut down, liquidated, foreclosed or stripped out in asset sales.

Ground Hog Day is Coming

We’re now in that part of winter that usually gets to me the most, when it’s cold, wet, miserable. It’s dark in the morning when I walk the dog before I take the kid to school, it’s dark when I walk her again after dinner. It’s always dark, always cold. The dog doesn’t seem to mind. She’s a Siberian Husky who was named “Tenacity” by the rescue folks who found her, all those years ago, chained to a pole in a swamp and left for dead.

During these early dark mornings it feels like it will be like this forever and I can’t even imagine walking her around in shorts and my “Got Hedge?” t-shirt someday in the future. But even though it feels like winter will last forever, I know it won’t.

To rest of us, exiles from game of Unicorn Bingo during the longest and strongest Unicorn Winter on record, we could use a dose of this Tenacity. Owning gold (and silver) is one way to just wait it out. As Bill Fleckenstein opined on a QTR podcast in the fall of ’19 (I think this one), you can argue with the Unicorns, you can try to short them, because they should be shorted and they should come back to earth, someday.

But it’s usually a disaster because of the Fed put, which looks to keep working until finally, one day, it won’t. There was another podcast I recently listened to with Grant Williams (which I can’t seem to find now), when he talked about his witnessing the end of the Nikkei Bubble from his vantage point in Japan at the time. No crash, no notable day of reckoning, the way he described it, “one day the Nikkei just stopped going up every day. It just started going down”. And it’s been down ever since, for thirty years.

But if you buy gold then everything the central banks do to keep the Unicorn Winter going is actually wind at your back. It feels good not to be endlessly fighting the Fed and doing it without having to actually drink the kool-aid.

If you run a business, like I do, that has to survive the Unicorn Winter, then you need that muscle and fat Galloway ascribes above. You need actual customers for whom you can provide value, not data cows to mine and surveil. If you’ve made it this far without taking on VC, don’t start now.

Connect with other unfunded, real businesses doing actual stuff and start working together: joint ventures, co-branding, white labeling, sell your customers what they want instead of loading up on VC and taunting them with shiny new objects.

If you aren’t already, get involved in the crypto economy. After the everything bubble pops, I think it will be one of the segments that fills the vacuum.

If you can get your business to the point where you can continue operating in your niche no matter how long the Unicorn Winter lasts, just imagine how things will be when it’s over. I’ve said it before, the two periods where we experienced the most explosive growth at easyDNS were immediately after the bursting of the .com bubble and then again after the GFC.

My latest book: Unassailable: Protect Yourself From Deplatform Attacks, Cancel Culture and other Online Disasters is available now.

As an Amazon Associate OOTC earns referral fees from the book links we cite in our posts.